- Expert advice/

- Relationship advice/

- Newlywed couples/

- 10 Things You Should Do as a Newlywed

- Newlywed couples

10 Things You Should Do as a Newlywed

From financial planning and taxes to insurance and legal documents, follow this 10-step list to help you get your newlywed life up and running smoothly in no time.

Last updated February 5, 2024

Congratulations—you’ve danced your first dance, fed each other bites of cake, and waved goodbye to your guests through the smoky haze of your sparkler exit. You’re married! While everything on your wedding planning to-do Checklist has been crossed off (except for writing thank you notes, of course), there are still some things you need to take care of now that you’re legally wed.

From financial planning and taxes to insurance and legal documents, there can be an overwhelming number of tasks to do—which is why we’ve created this 10-step list to help you get your newlywed life up and running smoothly in no time.

1. Request Your Marriage Certificate

Your marriage certificate (not to be confused with your marriage license confirms the date, time, and legality or your marriage in the eyes of the state. Getting several certified copies of your marriage certificate should be your first course of action, as you’ll need to present this document in order to take most of the steps we outline below. Here are just a few situations that require a marriage certificate:

- To update your identity via a legal name change

- To claim legal married status for tax and Medicaid benefits

- As proof of relationship

To get copies of your marriage certificate, contact or visit the vital records office within your local state government office. It’s recommended that you order 1-5 copies of your marriage certificate for immediate use in taking the below steps, and an additional two to keep for your own personal records and as proof of identity.

2. Change Your Name (if You Want)

If you’ve decided to change your name to indicate your married status, there are many institutions and businesses (each with their own set of paperwork) at which you’ll have to make the switch. After getting certified copies of your marriage certificate, your first stop should be your local social security office to legally change your name with the US government. Then start updating other important legal docs, accounts, and personal listings. Here’s a brief (and definitely not exhaustive) list of things you’ll need to update with your new married name:

- social security card

- driver’s license (and other identification)

- financial accounts

- credit cards

- postal address

- passport

Check out our article on How to Change Your Name for more guidance on how to navigate this process with ease.

3. Open a Joint Bank Account

Even if you decide to keep separate bank accounts, it’s really helpful to open a joint bank account once you’re married. If you’re keeping separate accounts, you can still both deposit funds in here to pay for shared expenses or to begin saving for big-ticket items down the road. Or choose to collapse all your accounts into one in order to streamline your finances and truly go all-in on sharing everything, deposits and withdrawals and all.

4. Open a Joint Credit Card

Similarly, a joint credit card is another helpful life tool that you and your new spouse will want to get your hands on. Set up recurring payments for daily living costs like utility, water, phone, and cable bills; charge your honeymoon or other travel expenses to it to rack up points or miles; purchase furniture or other must-haves for your newlywed home; buy Christmas presents for your families; or just splurge on a few romantic date nights out.

You can still keep separate credit cards for individual purchases (or gifts you don’t want your spouse to know about), but a shared credit card is just a practical financial solution.

5. Budget Together

Maybe it’s a new car, a starter home, a luxury vacation, or preparing to start a family: whatever goals you have for your future life together, they’re going to come with big expenses. Therefore it’s important to get in sync about your saving and spending habits. Plan a night to discuss your family budget: pour some wine, get cozy, and have an honest discussion about your financial priorities and comfort levels.

Marriage is all about compromise, so you might as well start practicing now—and coming to an agreement about how to handle money is a key piece of a happily married life. Once you’re on the same page about how to accomplish your financial goals, and you have a plan for making them happen, it will be easier to keep each other accountable and stick your budget together.

6. Get Life Insurance

You’re no longer a single entity moving through the world—now that you’re married, whatever befalls you also befalls your partner. In the unfortunate case that something major happens to one of you, you’ll want to be sure the other is protected and taken care of financially.

While no one likes to think about potentially tragic situations, buying a life insurance policy is just a smart move for peace of mind. Luckily there are plenty of life insurance agents out there that can walk you through the process and set you up with a policy that fits your budget.

7. Invest in Your Future

Speaking of unforeseen circumstances, one of your most important jobs as newlyweds (besides making use all of your great Registry Gifts) is to figure out how to set priorities, and plan for, your future. You might have even received checks or cash funds as part of your wedding gifts—so how do you plan to use this nest egg? Do either of you have any student loan debt to pay off, and if so, how will you handle it? At what age would you like to retire, and how much money will you need to save in order to do so?

If you don’t already contribute to a 401(k) through your employer, talk to a financial advisor about setting up an IRA or other retirement-savings account for both of you. It’s also a good idea to discuss creating an investment portfolio with your advisor while you’re at it—this is the time to set yourself up for long-term financial success with your new life partner.

8. Plan for Your Taxes

Getting married has tons of perks (a lifetime of love, support, and companionship, for one). One of the financial perks of marriage are the potential tax benefits that might accompany your new legally married status. From potentially lucrative credits you could earn, to various deductions you can make, to even deciding exactly how to file and who should claim what, taxes become a lot more complex after marriage.

To make sure you understand how your married status changes your tax situation, and to ensure you’re making the wisest and most informed tax decisions, talk to an accountant or tax advisor to find out what sorts of credits, benefits, or other rules and regulations you should be aware of now that you’re no longer single in the eyes of the US government.

9. Update Your Marital Status

Much like changing your name, there are many businesses and institutions that care about your marital status. Where you might have marked “single” before, now you get to go back and check the “married” box—which hopefully is exciting enough to make this task less tedious. Here’s a brief overview of some of the places you’ll need to update:

- Your employer’s HR department

- Bank(s)

- Insurance company

- Landlord or co-op board

- Membership clubs where your spouse would have access or privileges

Be mindful that this list will change (and most likely increase) for every individual, so be sure to think through any other business offices, institutions, or memberships where your relationship status will have an impact and alert them according.

10. Make Plans for Your Estate (and End-of-Life Care)

Life is unpredictable, so planning for its ups and downs is just plain smart. Legally record your wishes for what should happen in the unfortunate circumstance where one of you is no longer around or capable of making decisions. First off, designate your spouse as the beneficiary for the following types of accounts:

- Existing banking accounts (checking, savings)

- Life insurance

- Investments (stocks, bonds, mutual funds)

- Retirement accounts (401(k), 403(b), IRA, Roth IRA)

- Military benefits

- Pension (SEP, SARSEP)

- Trusts

- Any other property, titles, and assets

Next, meet with an estate attorney to create a Will that determines how your assets are distributed after your death, as well as defines guardianship of current or future children. Finer details of Wills include establishing trust funds and/or inheritance plans for children, and even making plans for pets.

While meeting with your estate attorney, also decide whether you’ll grant power of attorney to your spouse, which lets him or her have decision-making power over your finances. Without a Will in place, state laws determine how your estate is distributed and who can make decisions for you, so don’t ignore this one.

Lastly, consider creating a Living Will if you want to be the one to make your own healthcare decisions down the line. Without a Living Will, generally your spouse (or an immediate family member) will the one forced to make decisions about your care if you are unable to. You can also create an Advanced Directive that outlines your specific wishes about care you might receive near the end of your life, and grants a designated agent the power to enforce these wishes.

While we know some of these things are pretty heavy (or just plain unfun) to think about, they are all critical for setting you and your new spouse up for a lifetime of success, happiness, and fulfillment. So try to find the excitement and joy in merging your two lives into one—and when in doubt, throw a little champagne at the situation to make it more celebratory. Best of luck on your future road together, newlyweds!

Up next for you

How to Change Your Name After Marriage

How To

Thinking about changing your last name? Here's everything you need to know when considering a name change after marriage. Learn more.

How to Write Wedding Thank You Cards

How-To

Here are some etiquette tips and timing guidelines to help you mail your wedding thank you notes in proper style.

Wedding Thank You Card Wording: Tips & Examples

How-To

Craft heartfelt wedding thank you cards with our expert guide. From wording to personalization, learn to convey appreciation in every note you write.

Where You Can (and Can't) Wear Your Engagement Ring

Inspiration

Diamond experts share all the places you can wear your engagement ring and where you shouldn't wear your ring. Plus, tips for keeping your engagement ring like new.

A Guide to Marriage Licenses

Inspiration

Your marriage license isn’t the most exciting task on your road to married life, but it is a requirement for your union to be deemed legal. So how do you go about getting a marriage license? Our guide covers it all.

Featured

Essentials to Put on Your Wedding Registry

Inspiration

Get started building your registry with our a super-comprehensive checklist of list registry essentials, straight from our team of experts, that will cover ALL of your needs and help you build the newlywed home of your dreams.

How Much Does the Average Wedding Cost in 2024?

Advice

Stay within your wedding budget! See average wedding cost breakdowns by state, guest size, and vendor service, plus money-saving tips from the experts.

How to Plan a Wedding: A Step-by-Step Guide

How-To

We’ll walk you through the steps of online wedding planning, highlighting all of Zola’s incredibly easy and intuitive online wedding planning tools that’ll make planning for the big day more fun and less frustrating.

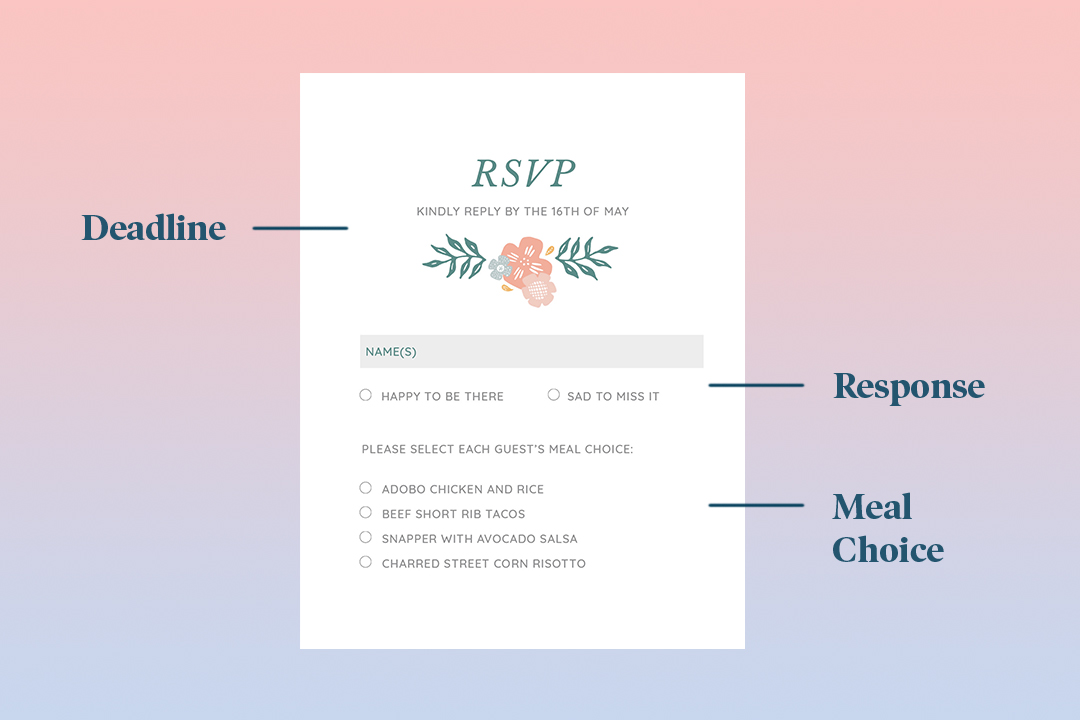

How to RSVP to a Wedding

How-To

If you've received an invitation to a wedding and you're not sure how exactly to respond? This is our guide to wedding RSVP etiquette, tips, and steps.

Wedding Invitation Wording: A Complete How-To Guide

How-To

Learn the how-to's of wedding invitation wording, plus formal and casual wedding invitation examples from the experts.

2024/25 Printable Wedding Planning Checklist & Timeline - Zola

Don’t miss a wedding planning detail with our complete, expert-crafted wedding checklist and timeline. Free, printable version inside!

- Expert advice/

- Relationship advice/

- Newlywed couples/

- 10 Things You Should Do as a Newlywed

Find even more wedding ideas, inspo, tips, and tricks

We’ve got wedding planning advice on everything from save the dates to wedding cakes.